Here's the game you didn't know you needed to play

Electricity distribution networks are complicated. So are the games based on them.

Q3 of 2023 has shown significant decreases to average wholesale electricity and gas prices, but we're not out of the woods yet with retail energy pricing.

The AER has released the Q3 2023 wholesale markets quarterly report. Overall energy demand is down, wholesale prices are down, and solar generation is up. However, there's still time to go before this translates to significant retail price reductions.

https://www.aer.gov.au/publications/reports/performance/wholesale-markets-quarterly-q3-2023

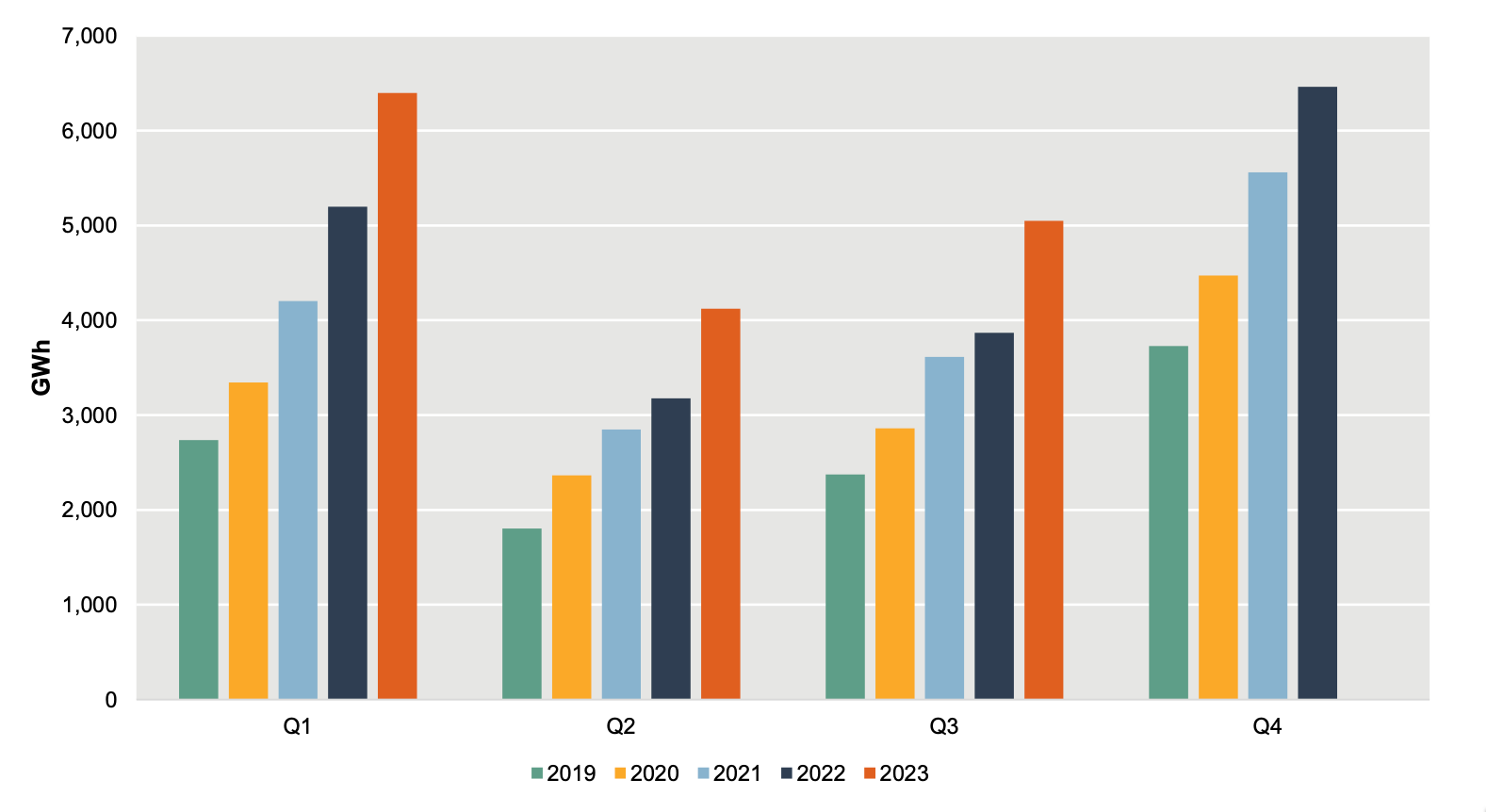

Demand in Q3 2023 was the lowest ever recorded for Q3, averaging about 5% (or 1,200 MW) lower than in Q3 2022. At a regional level, the magnitude of the decrease ranged from 2% in Queensland to a whopping 10% in South Australia.

2023 is also the first year ever where Q3 demand was lower than Q2 demand. Lower demand puts downward pressure on prices because less high-priced capacity is needed.

Q3 demand is typically high in southern Australian regions due to the increased demand for heating in the cold winter months. 2023 was the first year ever where Q3 demand was lower than Q2 demand.

Minimum daily demand also fell to record low levels this quarter, including a record low of only 29 MW was recorded for all of South Australia on 16 September

Record lows of 4,202 MW and 2,103 MW were recorded in NSW and Victoria, respectively, on 24 September. Mild weather was a key driver of the historically low demand.

Another factor contributing to lower demand was a huge increase in rooftop solar output. Rooftop solar generation, which is accounted as negative demand, was a massive 31% higher than in Q3 last year.

This increase in solar generation was driven by the continued rapid growth in rooftop solar installations plus generally sunnier conditions.

In September, rooftop solar output was 41% higher than the same time last year, and on 30 September, output reached a record high level. Because of the growth in solar installations since last year, this record output will likely be surpassed in Q4.

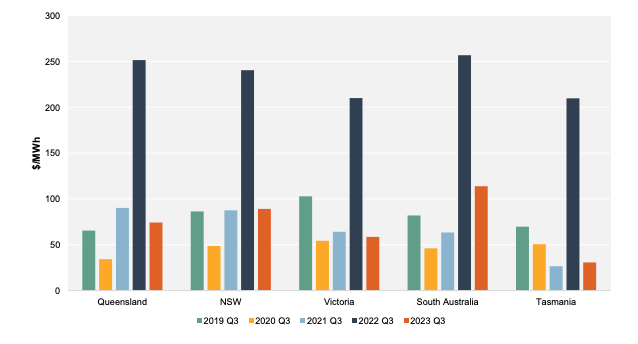

Reduced demand coupled with lower-priced dispatch offers from generators, has resulted in a dramatic decline to average wholesale electricity spot prices, a very welcome change after the unprecedented increases seen in 2022.

Prices for Q3 2023 were less than half the levels reached in Q3 2022, when a perfect storm of coal generator outages, fuel supply issues, high international fuel prices, and high demand drove the highest Q3 prices on record.

Average prices this quarter returned to a similar level as Q3 2021 in all states except South Australia, where prices remained well above typical Q3 levels.

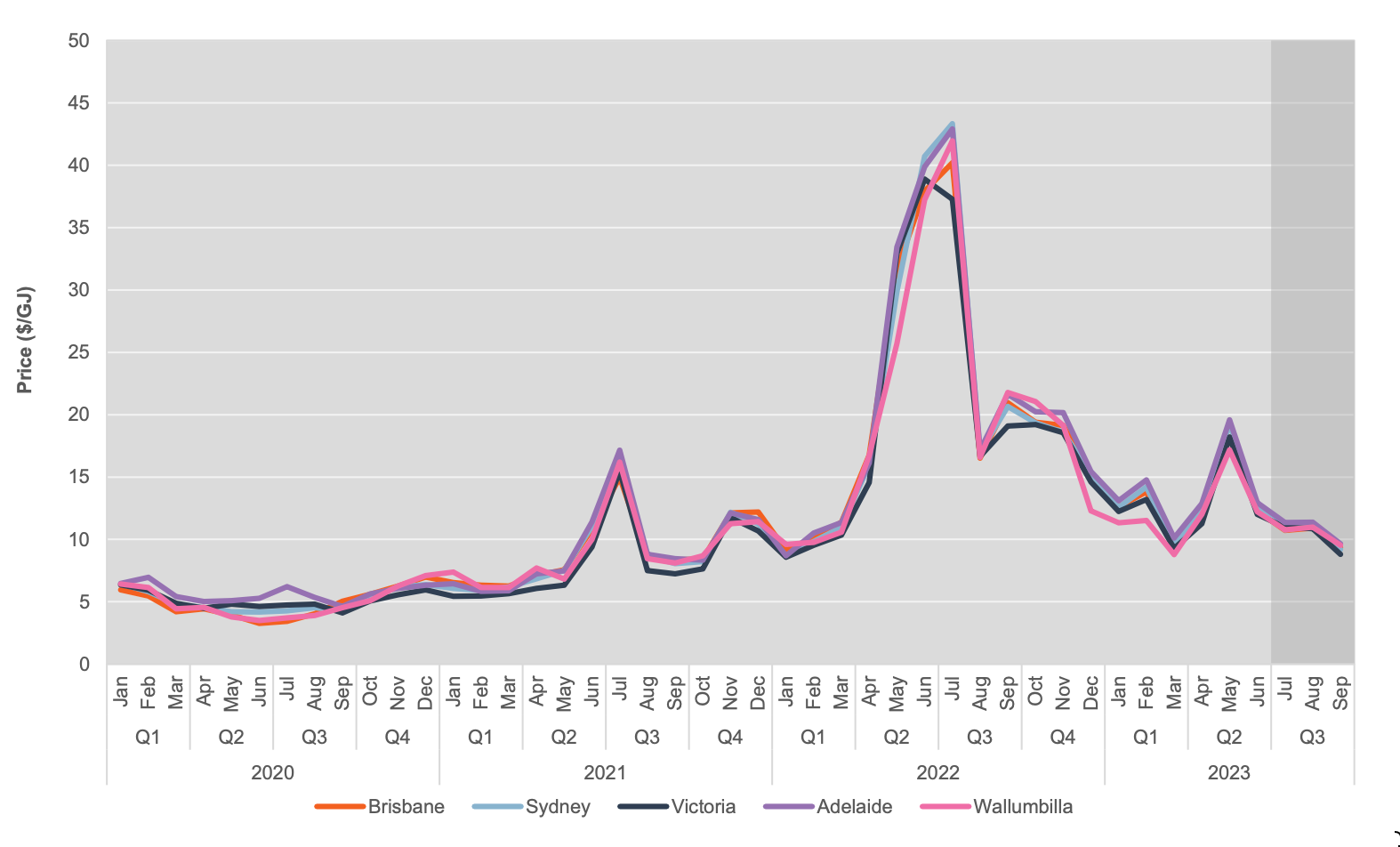

Over Q3, East coast gas market average spot prices were down 28% from the previous quarter and 60% lower from Q3 2022 , reaching average levels last seen on a sustained basis in Q3 2021.

Retail energy prices trail wholesale prices and largely rely on the price of futures contracts entered into by energy generators and retailers 12 months or more in the past. The futures market is integral to protecting both parties against price fluctuations in the wholesale spot markets. Forward base futures prices illustrate price expectations for electricity spot prices in future periods.

Base futures prices for Q3 2023 fell over the quarter, due to lower-than-expected spot prices. Forward prices also fell for Q4 2023 and 2024. Looking further ahead, base futures prices for 2025 remained steady.

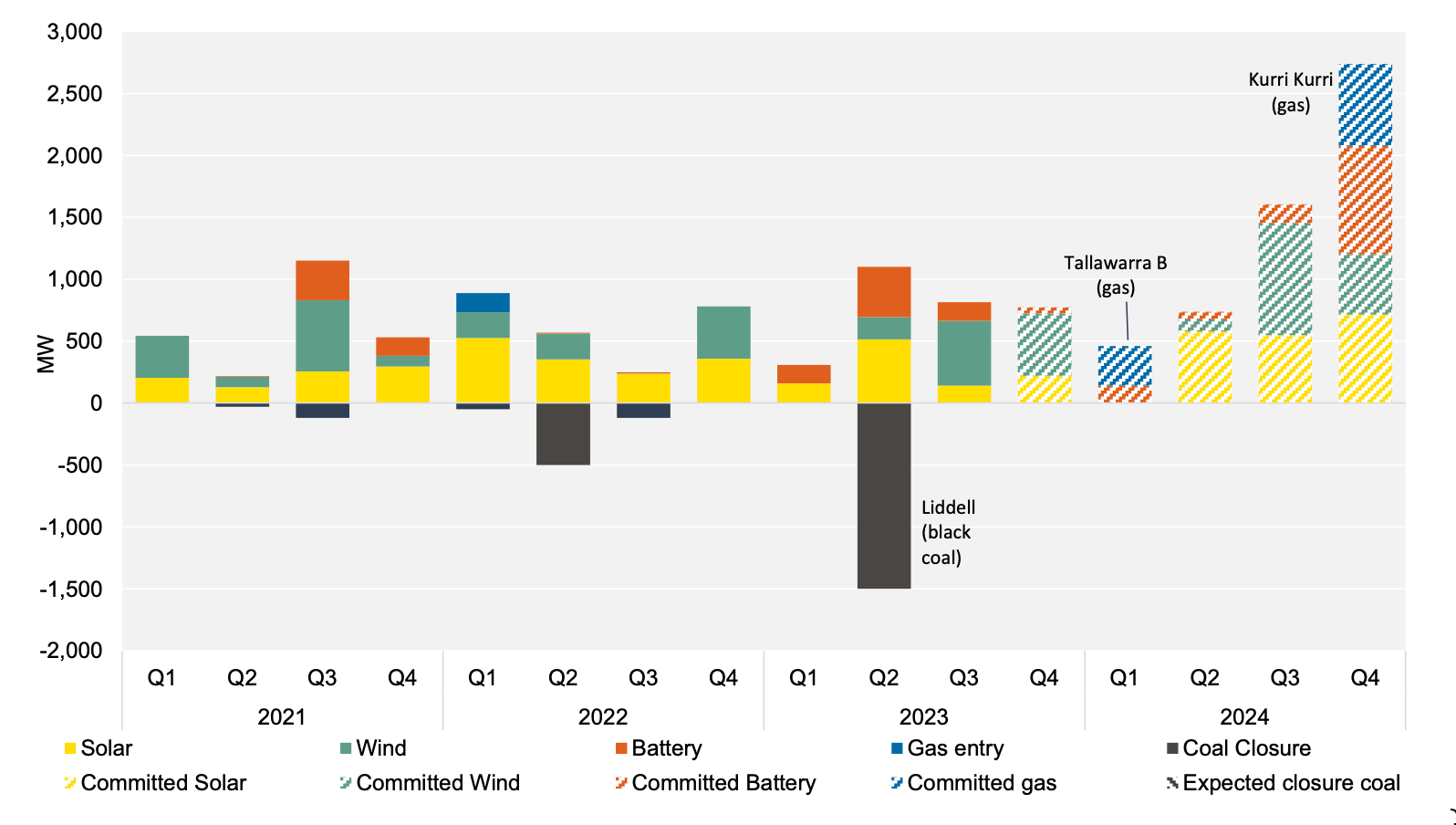

This report sounds an alarm for the timing of new generation capacity required to enable the decommissioning of legacy coal assets that are becoming increasingly unreliable. Lack of supply will be a significant factor likely to keep energy prices inflated into the future.

Overall, the rate of new entry into the market is not in line with what the market needs to transition. In Victoria, for example, no new capacity has entered the market since April. AEMO’s 2023 Electricity Statement of Opportunities (ESOO) identified forecast reliability gaps for all mainland regions over the next 10 years.10 With 8.3 GW of firm capacity scheduled to exit the market in the next decade as coal plants retire, there is a pressing need for new investment to be realised across the NEM.

Savings as a Service is the blog site and newsletter from Bill Hero. Subscribe now and get your energy savings tips and information delivered fresh to your inbox every month.