Here's the game you didn't know you needed to play

Electricity distribution networks are complicated. So are the games based on them.

After a tumultuous 9 months of severe price increases, spot prices across the NEM are returning to normal levels. Will retail prices follow?

Welcome to the 13th edition of Savings as a Service, the newsletter from Bill Hero. As they say in bingo halls everywhere, 13 is 'unlucky for some'.

Although wholesale spot prices have come down after a radical leap into the stratosphere over the previous 9 months or so, retail energy prices remain high, and as we saw in our previous issue, retail prices are slated to climb even higher before they come back down.

Sadly, our luck as retail energy consumers has not changed, and the bill-shock horror is set to continue.

Even though there's still more pain in store for retail energy, Bill Hero can help you stay on the best available prices. If you're not already a subscriber, there's no better time to join.

Not a subscriber yet? What are you waiting for? Never overpay for energy again! Bill Hero automatically compares every bill to help keep you always on the best-priced plan.

Australian energy consumers will be pleased to know that after tumultuous price increases, spot prices across the NEM are finally returning to a more normal level

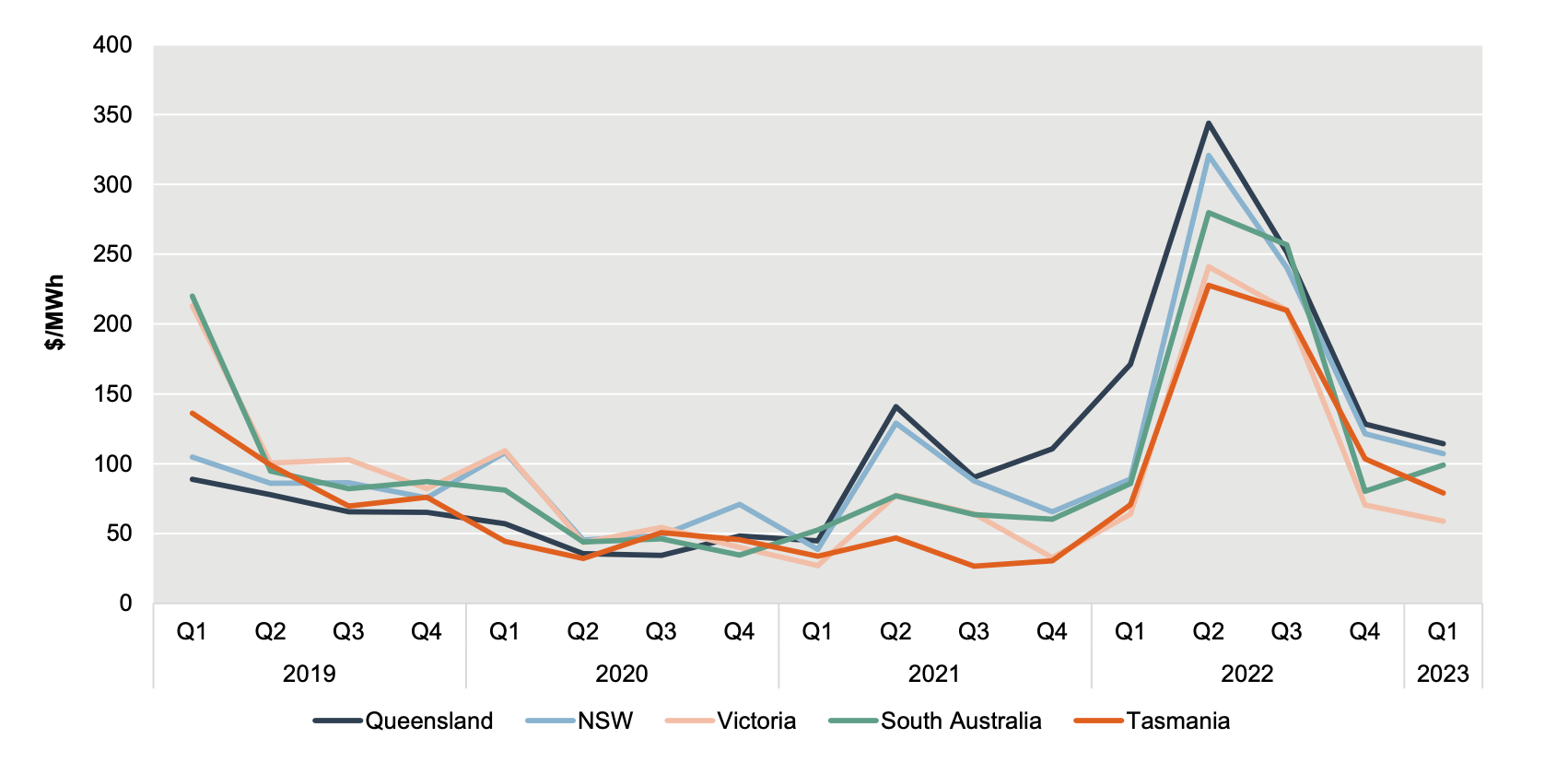

The AER's Wholesale Markets Quarterly Report for Q1 2023 reveals that average spot prices in Q1 2023 were considerably lower than the all-time peak in Q2 of 2022.

lower than

Despite increased electricity demand, average NEM spot prices over Q1 2023 were lower across all regions except South Australia.

This was mainly the result of higher generation capacity offered into the market at lower prices by coal, gas and solar generators. Average quarterly prices ranged from $64/MWh in Victoria to $114/MWh in Queensland.

South Australia was the only NEM region with a price increase, driven mainly by increased seasonal electricity demand due to heat waves.

This is welcome news for wholesale energy in Australia.

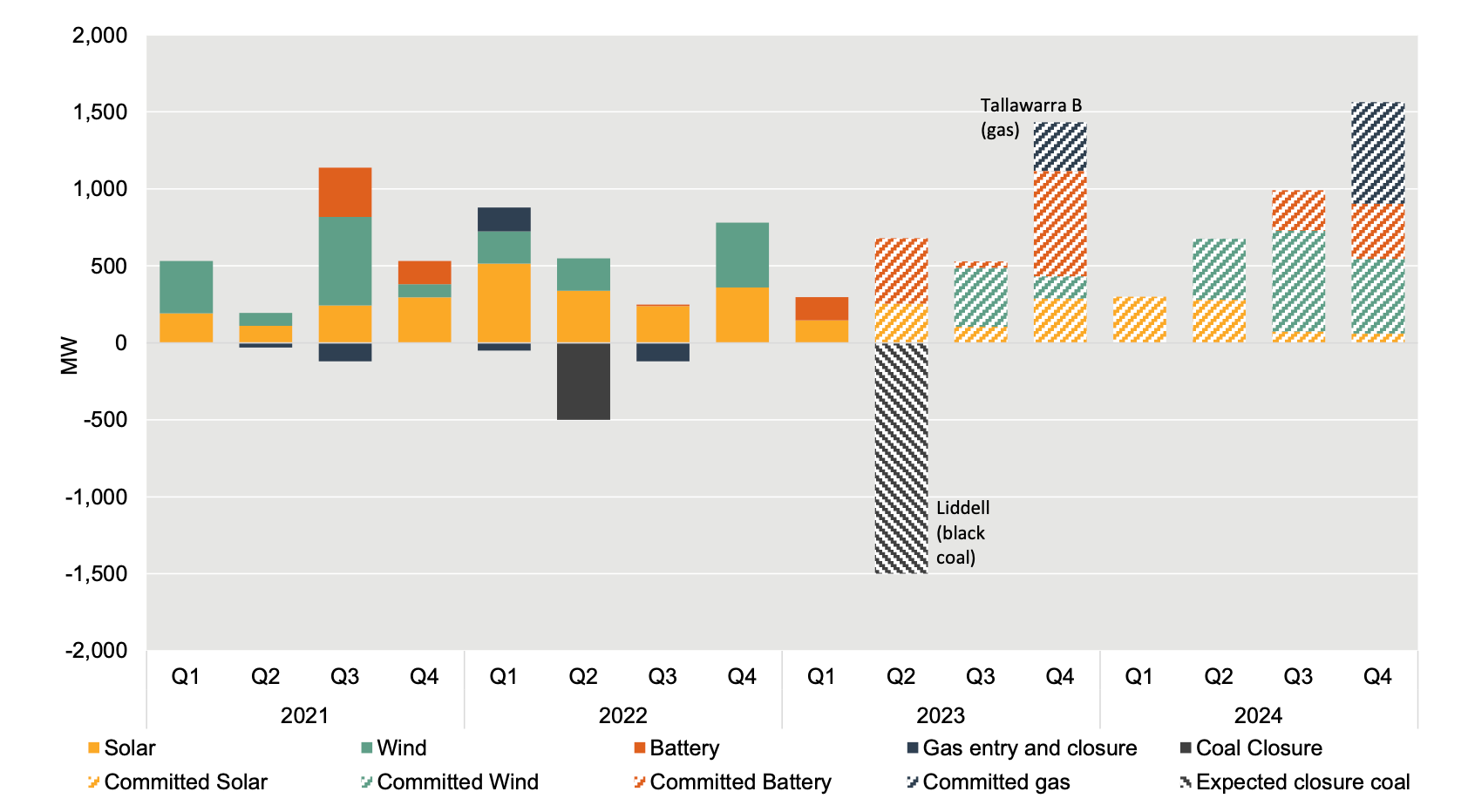

The big upcoming story around wholesale pricing and generation capacity is the closure of AGL's Liddell coal generation plant in the Hunter Valley.

ABC Archive photo

Commissioned in 1973, Liddell is now one of the oldest coal-fired electricity generation plants in operation anywhere worldwide.

AGL announced in 2015 that it planned to close the Liddell Power Station in 2022. Fearing generation shortfalls and price increases, the Turnbull government asked AGL to either keep Liddell running beyond 2022, or to sell it to Alinta. In August 2019, AGL announced it would keep three of the four 500 MW turbines running until April 2023 to support reliable power supply to NSW through the summer of 2022–23.

The first turbine was shut down in April 2022, and the other three will be closed this week, on Friday, 28 April 2023, removing about 1,500 MW of generation capacity from the NEM.

The site will be repurposed for a big battery of 500MW capacity - much larger than the Tesla big battery in South Australia.

This will no doubt trigger supply constraints and wholesale spot price increases from Q2 this year.

While that is an undeniably large chunk of capacity, there is significant new generation capacity in the pipeline to replace it, so the spot price impacts should be constrained.

Although gas is obviously a separate energy source from electricity, wholesale gas prices directly influence electricity spot prices since gas is used as an input fuel for 'peaking' generators which are fired up as needed to meet electricity demand and play a significant role in price setting.

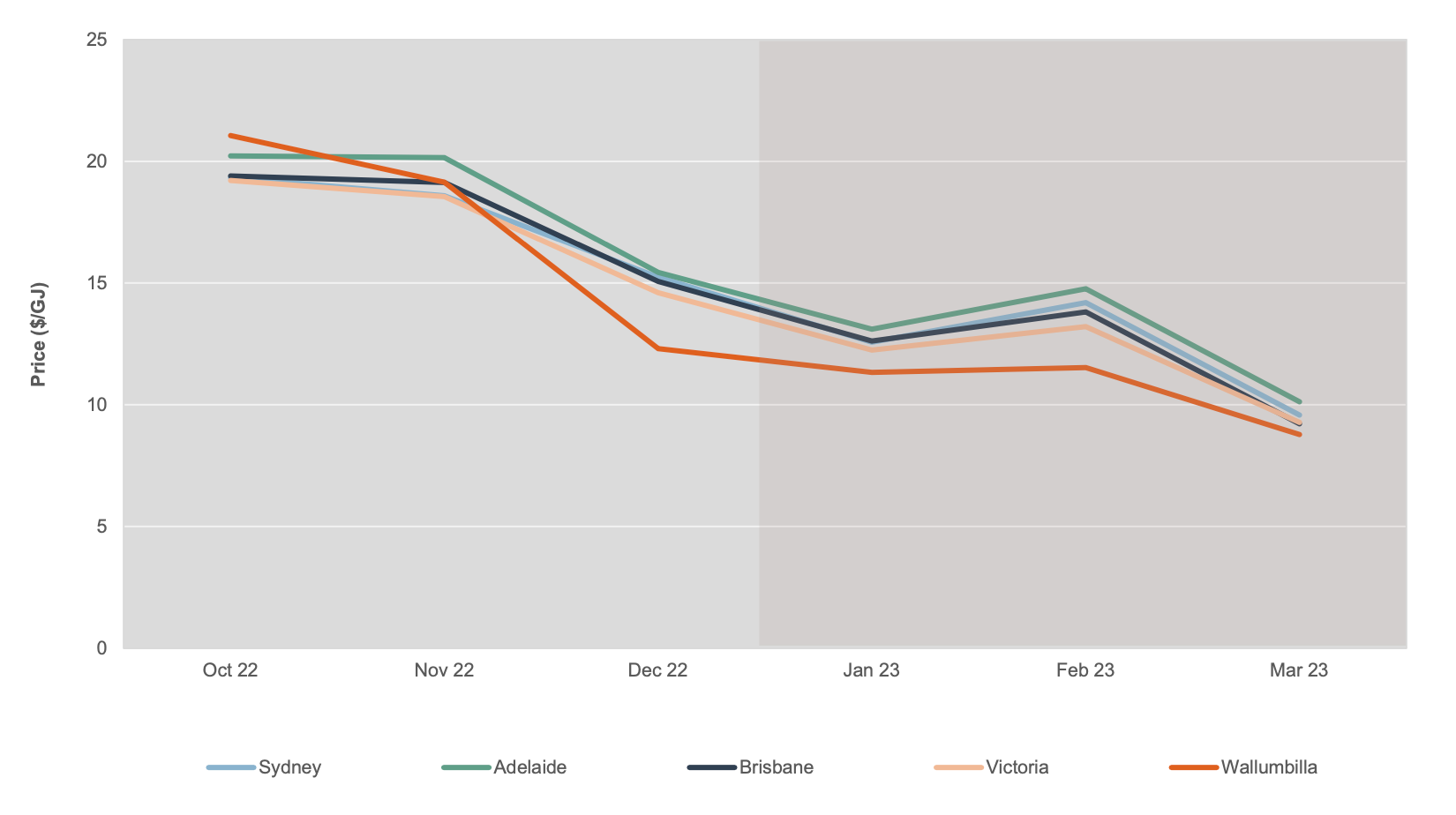

The good news is that wholesale gas spot prices have also eased across the Australian east-coast market.

We've previously commented on how the Australian wholesale gas market is exposed to global pricing and how domestic prices are impacted by so-called 'supply shortages' caused by gas exports.

After a tumultuous year, Asian gas prices have decreased from over $40/GJ to below $20/GJ in March 2023, and maintenance outages for the gas export pipelines for Shell's Queensland Curtis LNG operation meant some gas intended for export became available to domestic consumption, driving down the local spot price.

However, the main driver will be the mandated gas wholesale price cap of $12 per GJ set by the federal government in December 2022 under powers now delegated to the ACCC.

It's good news, in principle, that wholesale energy pricing is now returning to less crazy levels, but most of us care more about retail pricing.

Wholesale markets determine the spot price for wholesale energy, which is the final price per MWh at which electricity is dispatched in any 30-minute dispatch period.

Spot prices are exposed to potentially severe price fluctuations, so retailers use hedging to manage the volatility risk.

This requires retailers to pre-purchase electricity from generators and brokers at known prices. These forward prices are locked in when the hedging is purchased, so it takes time for wholesale price changes to manifest in retail pricing.

We already know from the last issue of Savings as a Service what's in store at the retail level from the next price reset that will occur in July 2023.

Retail price rises of up to 30% or more are locked in across the NEM, and we'll all see the impact in our bills from July 2023.

As prices are set to climb higher, getting on top of your energy consumption remains very important. Bill Hero's Energy Coach has your back with actionable, timely tips and straightforward advice to maximise comfort in your home while minimising energy consumption.

Got opinions about energy bill pricing? Have your say in the comments, but please first read and understand our Community Guidelines.

Savings as a Service is the blog site and newsletter from Bill Hero. Subscribe now and get your energy savings tips and information delivered fresh to your inbox every month.