Here's the game you didn't know you needed to play

Electricity distribution networks are complicated. So are the games based on them.

High energy prices are here to stay, due to coal closures, and a domestic gas supply 'shortfall' projected for winter 2023

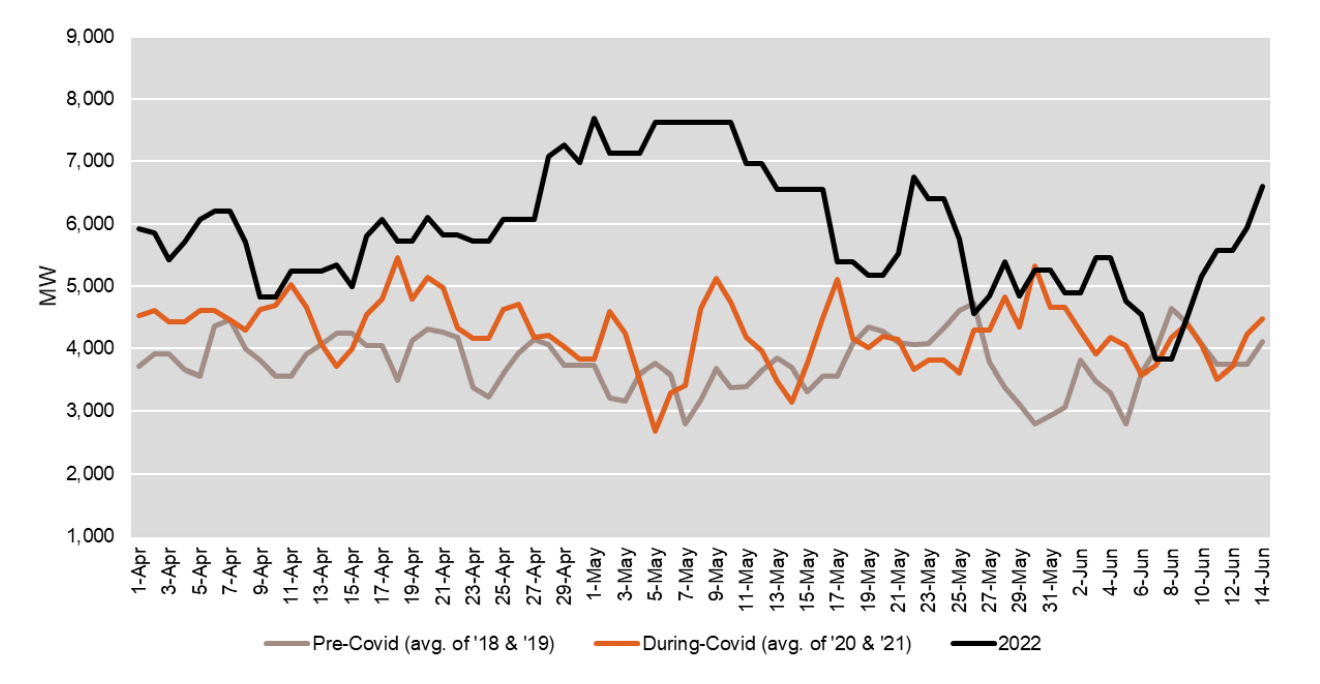

Recent months have been the most tumultuous in the history of Australia’s energy markets. International and domestic pressures combined to drive dramatic price increases in both the wholesale electricity and gas markets. The extent and persistence of high prices, which reached record levels in June and July, triggered protective price caps, market interventions and spot market suspensions.

The AER has published its Wholesale Markets Quarterly report for Q2 2022, which analyses how and why spot prices in both gas and electricity reached record highs during the second quarter of 2022, leading to implementation of market price cap and temporary shutdown of the entire market.

Expectations are for high prices to continue in coming years. High fuel costs are likely to continue as international coal and gas prices remain at historical highs. Generation closures, including the impending closure of Liddell power station in April 2023, and tight gas supply conditions, with a domestic gas supply shortfall projected for winter 2023, means that market conditions will remain challenging for some time.

The report offers these summary insights:

Two issues standout in this analysis, both related to fossil fuels: coal generation plant outages, and gas fuel price and availability.

The NEM still relies heavily on coal-fired generation, and over recent months, a high level of coal generator outages restricted available generation capacity, meaning that more expensive generation was required to meet demand more often.

Some of this higher outage rate is attributable to maintenance postponement due to COVID. However, the ageing coal generator fleet is only becoming less reliable, and coal generator outages are only expected to be more of a factor in future years.

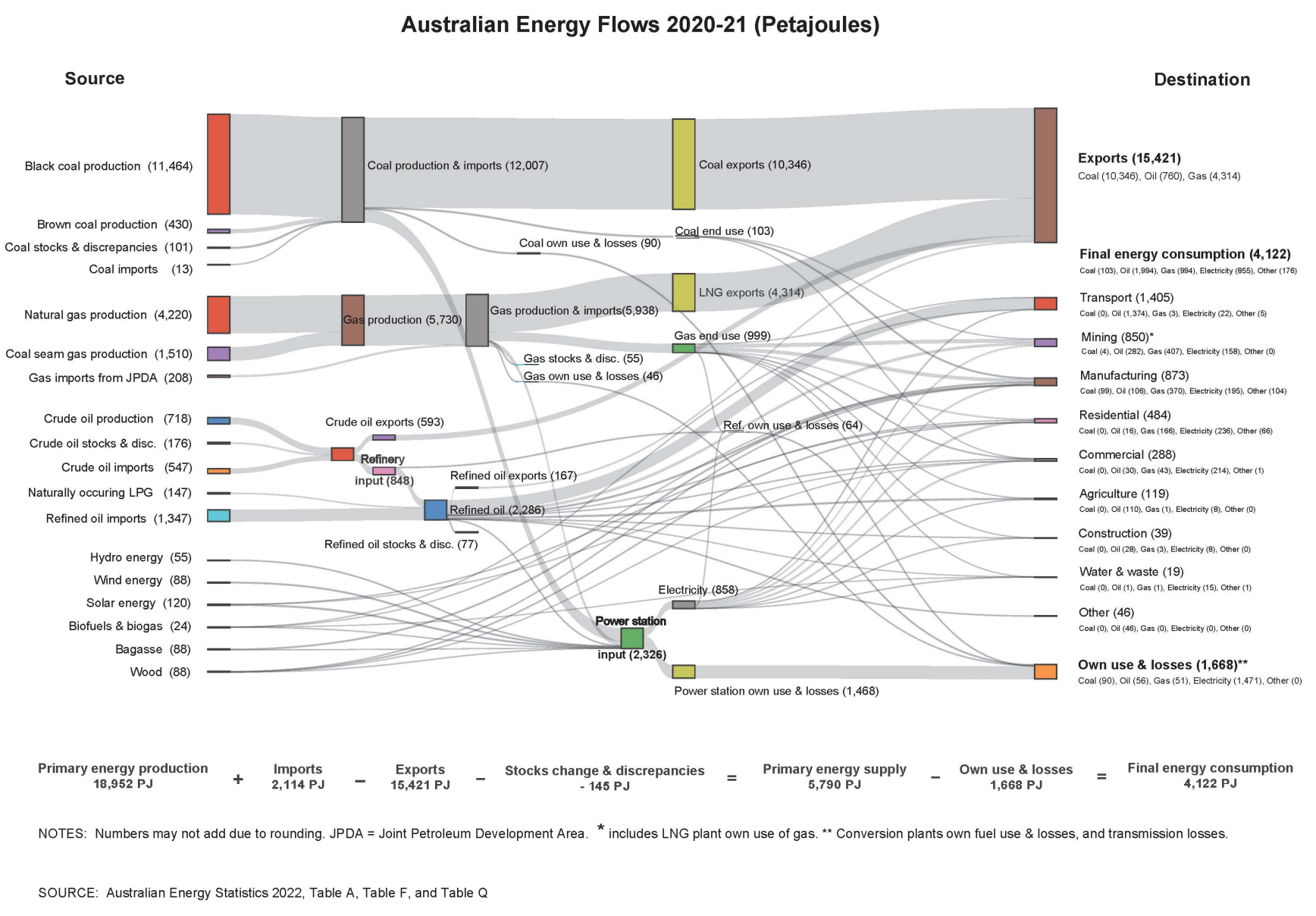

Australia is the world's biggest exporter of gas, but the gas industry claims we have a local supply shortage.

What gas supply shortage? https://t.co/Ed4rY9ELva pic.twitter.com/FwzZJSKOpB

— Bill Hero (@billhero) September 5, 2022

And taking a step back to an overview of the entire energy economy, its very clear that exports of coal and gas massively dominate domestic consumption. Any 'local supply' issues are not due to lack of fuel.

Savings as a Service is the blog site and newsletter from Bill Hero. Subscribe now and get your energy savings tips and information delivered fresh to your inbox every month.