Smart Meters are coming

The Australian Energy Market Commission (AEMC) is officially starting its Accelerating Smart Meter Deployment (ASMD) reforms. If you don’t already have a smart meter, you will by the end of 2030.

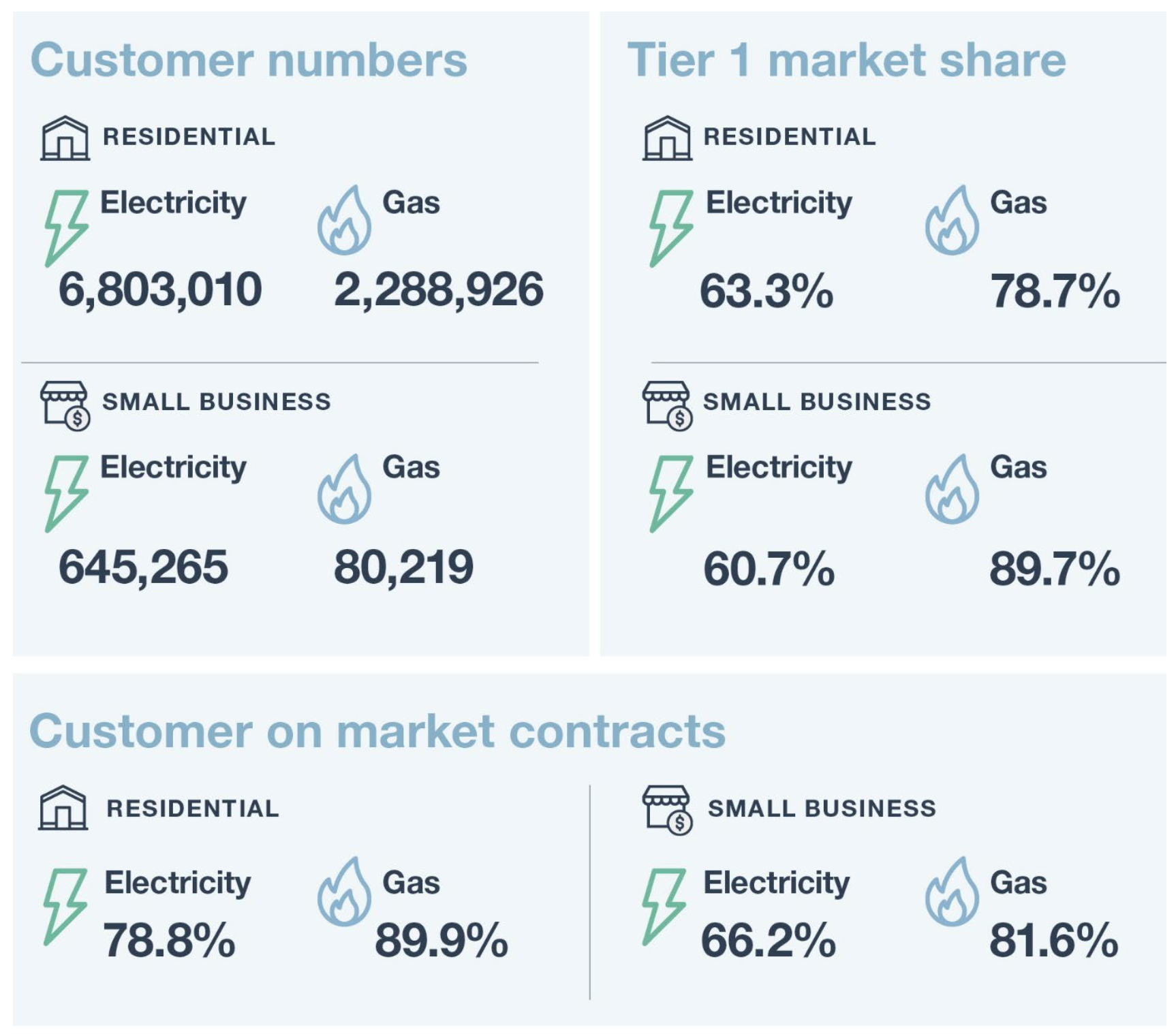

The Australian Energy Regulator (AER), publishes an annual report into various aspects of the retail energy markets in Australia, covering issues like pricing, customer service, competition, and the customer debt cycle.

The Annual Retail Market Report is the detailed annual report into the performance of the retail energy markets and energy retailers published by the Australian Energy Regulator (AER). The 2022-23 Report was published on 30 November 2023.

https://www.aer.gov.au/publications/reports/performance/annual-retail-markets-report-2022-23

The Retail Market Report covers a broad range of topics, including energy pricing and affordability, customer service, competition and market structure issues and all aspects of the customer debt cycle.

This report is intended to deliver an understanding of outcomes for consumers and the issues that impact them the most. It also informs the public, policymakers and the wider industry on how the retail energy market is performing for energy consumers.

2022-2023 witnessed a significant hike in energy prices across Australia. Residential electricity prices soared by 12-28% in most areas, with Victoria experiencing a slightly lower increase of 5-11%. Gas prices followed suit, with a rise of 3-37%, depending on the region. These increases are largely attributed to a spike in wholesale energy costs.

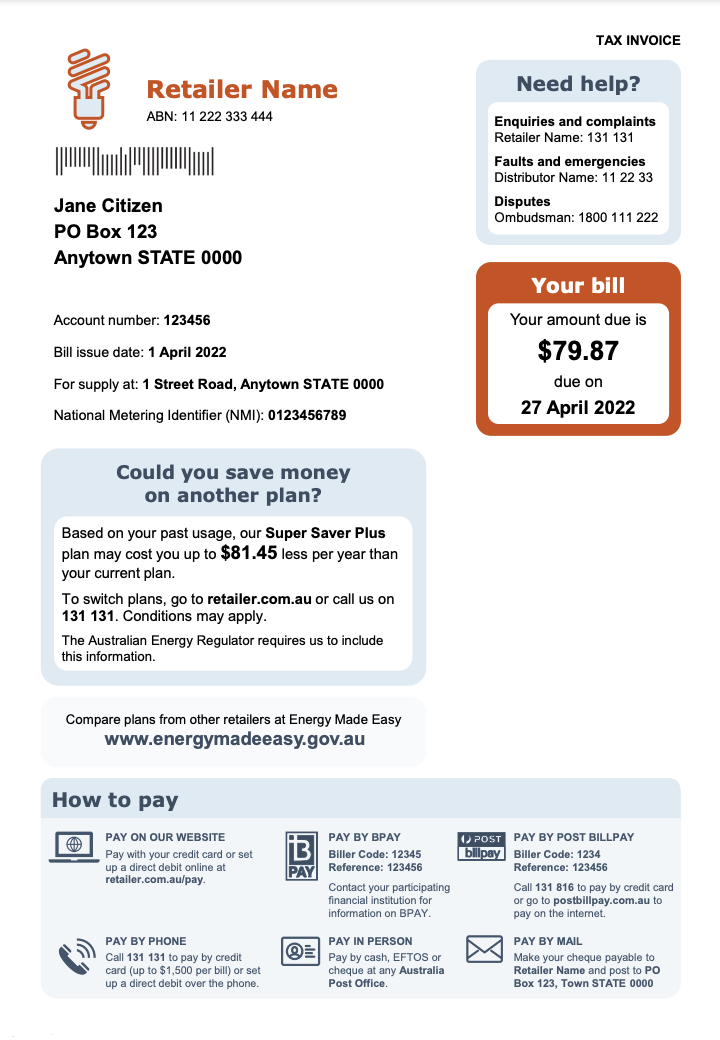

The report highlights a key finding: customers on market contracts generally fared better in terms of pricing compared to those on standard retail contracts. While the gap has narrowed over time, switching to a market contract could still save consumers up to 11% on their energy bills.

Affordability has become a growing concern, especially for low-income households. The proportion of income spent on energy has increased, indicating a decline in energy affordability. This trend is exacerbated by rising costs in other sectors, contributing to overall financial strain.

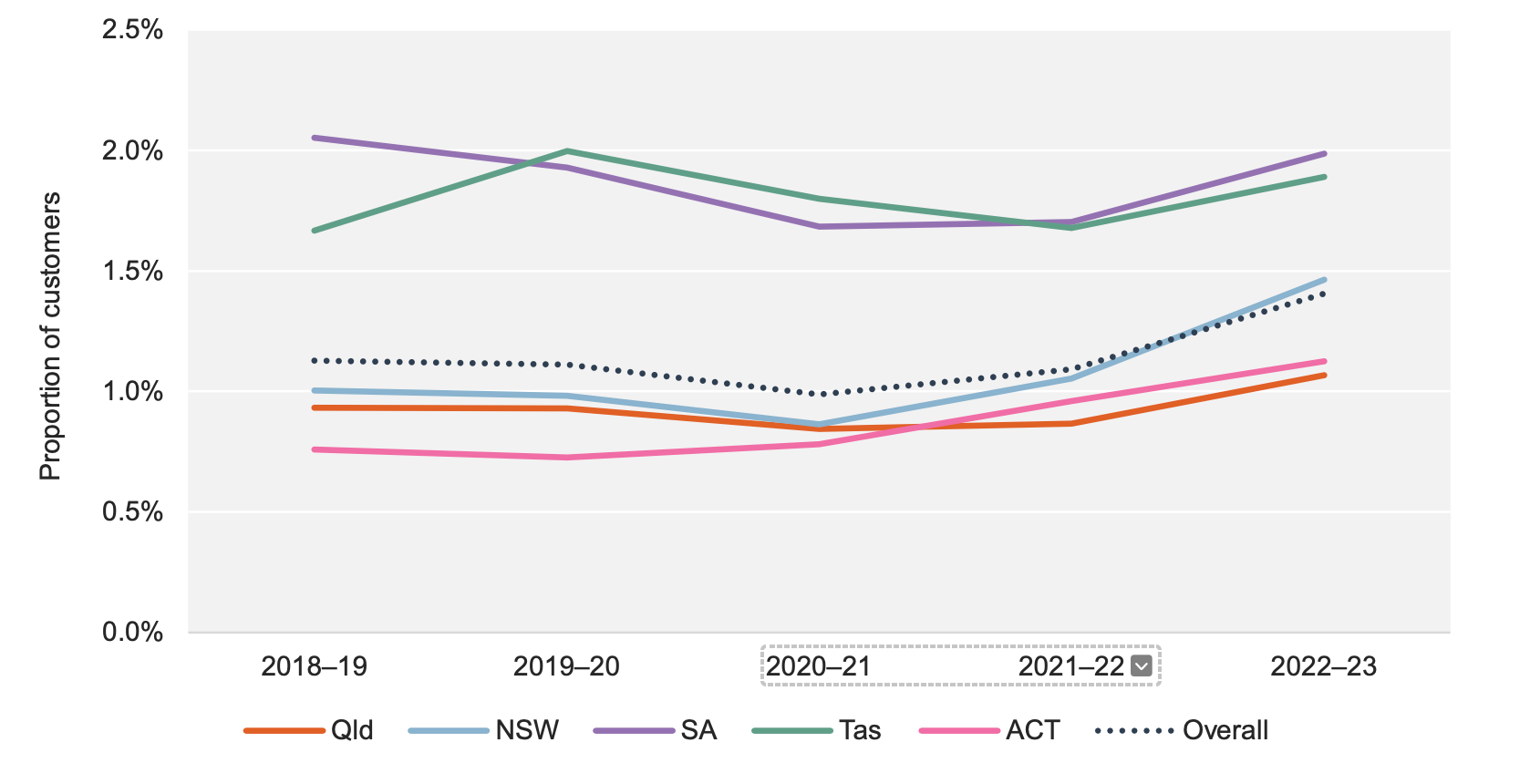

An alarming trend is rising energy bill debt, with more customers entering hardship programs.

The silver lining is that customers are seeking help earlier, as evidenced by a decrease in the average debt on entry to these programs. However, the effectiveness of these programs in fully addressing customer needs remains uncertain.

On a positive note, the report observes an improvement in retail competition. Despite a decrease in the number of active retailers, smaller retailers have succeeded in gaining market share. This suggests a healthy level of competition that could benefit consumers.

In response to these challenges, the Australian Government has announced the Energy Bill Relief Fund and is implementing the Better Bills Guidelines.

Furthermore, the AER is proposing reforms to enhance support for vulnerable consumers, focusing on concession systems, automatic hardship program placements, and financial counselling support.

These initiatives aim to ease the financial burden on consumers and encourage better deals from retailers.

The Annual Retail Markets Report provides a detailed snapshot of the current energy market, highlighting challenges like rising prices and declining affordability.

While there are signs of improvement in market competition and early intervention in customer hardship, more needs to be done.

Savings as a Service is the blog site and newsletter from Bill Hero. Subscribe now and get your energy savings tips and information delivered fresh to your inbox every month.